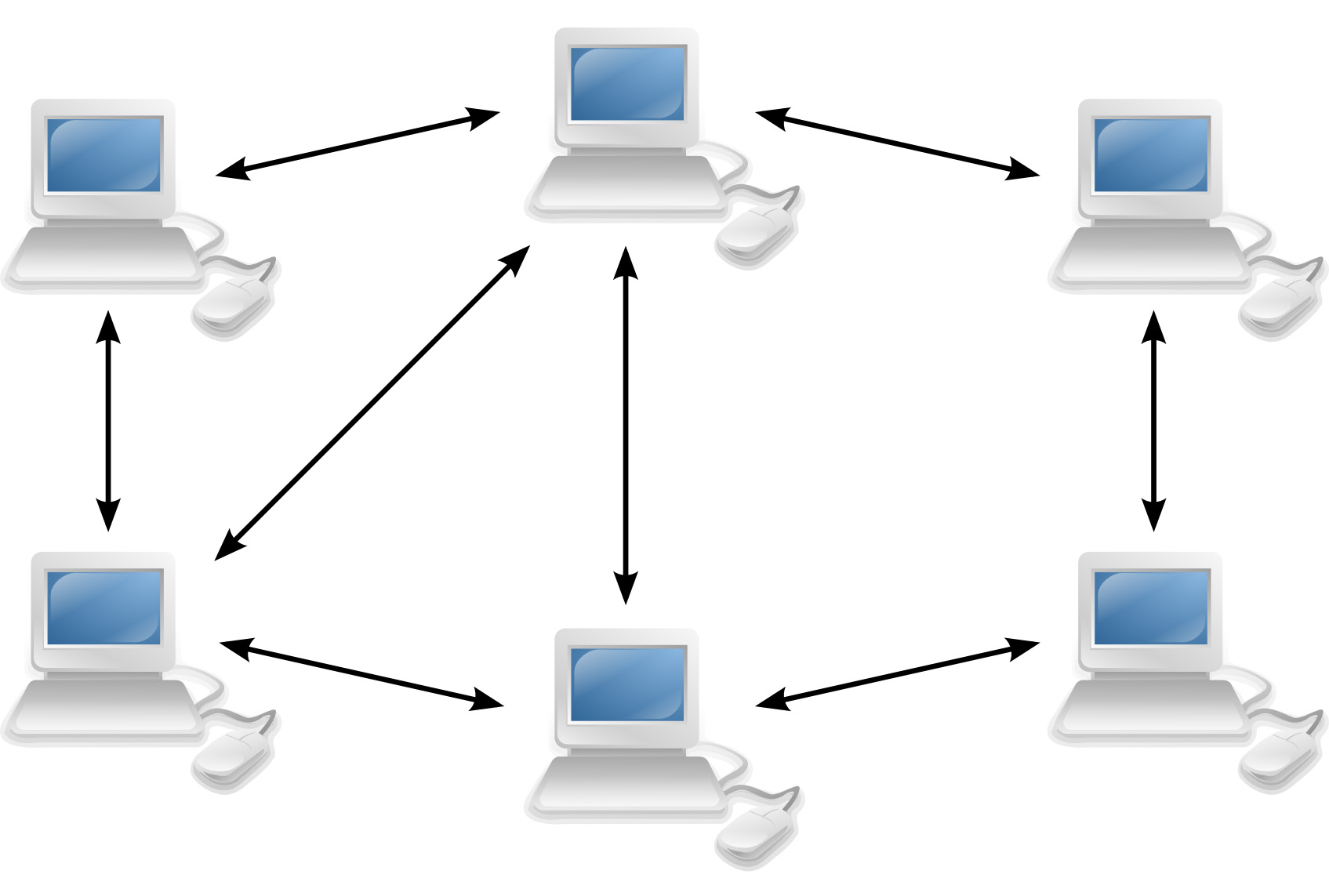

1 brand new and increasing supply of microloans (those below $35,000 to $50,000) are peer reviewed lending systems. Peer to Peer investing, also occasionally called social lending, suppliers make immediate loans involving investors and consumers potential.

Image Source: Google

There's not any third party intermediary for example in a bank where the bank accepts deposits then brings out those deposits as loans. These things join those who have cash to spend with individuals who want cash. These official networks and businesses didn't exist ten decades back.

Prosper.com – Prosper is your business juggernaut and brings to individuals and tiny companies that typically have fico scores between 620 – 699. This business was established in February 2006 and basically hailed the dawn of peer reviewed lending.

Funding Club – Lending Club was the 2nd biggest peer-to-peer lending website by volume from the USA, supporting Prosper. But at the first 2011 Lending Club surpassed Prosper. Lending Club is, and continues to be, the biggest regarding loans financed. The business was established in 2008.

LendingKarma doesn't provide loans from strangers. The business strictly eases connections between family and friends. Do you require business expansion financing along with your accountant or brother to supply you with the money in the kind of financing? LendingKarma can help. LendingKarma can help explain loan provisions, establish a repayment schedule, and monitor loan repayment.